Red Flags to Watch for When Selling a Home to a Cash Buyer

Selling a home to a cash buyer often promises speed and convenience, but not every offer is as secure as it appears. Sellers should be especially cautious of buyers who make unrealistically high offers, pressure for a quick close, or refuse to provide clear references and documentation. Recognizing these red flags early can help prevent costly mistakes and protect against scams.

Fraudsters may ask for sensitive information, use high-pressure tactics, or present confusing paperwork to trick homeowners into giving up their property or financial details. Being attentive and asking the right questions is essential to ensuring a legitimate and smooth transaction.

Key Takeaways

Watch for signs of unrealistic offers or vague buyer details

Be alert to pressure tactics or requests for sensitive information

Proper research and caution reduce the risk of scams

Key Red Flags to Watch for With Cash Buyers

When evaluating a cash offer, it's important to look for signs that the buyer may not be legitimate or may be trying to take advantage of the process. Being aware of red flags helps protect sellers from financial loss, wasted time, or legal complications.

Lack of Proof of Funds

Legitimate cash buyers provide proof of funds promptly. This is a basic requirement that shows the buyer has the financial ability to complete the purchase without relying on financing. If a cash buyer hesitates, delays, or refuses to supply bank statements, proof of funds letters, or other documentation, this is a significant warning sign. Verifying funds is not just a formality; it helps prevent deals with buyers who do not actually have the necessary capital. Some scammers present fake documents or vague statements, so sellers should verify the authenticity of any documents received.

That’s why it helps to verify documents through a trusted source to ensure everything is in order. Legitimate buyers are usually prepared and willing to share proof without delay. When you sell your home for cash fast with True American Homes, or any other buyer confirming financial readiness early on keeps the process simple. It allows both sides to move forward with clarity and peace of mind.

No Earnest Money Deposit

A serious cash buyer will put down an earnest money deposit as a sign of good faith. This deposit provides protection to the seller if the buyer backs out for reasons not covered by contract contingencies. If a buyer refuses to provide any earnest money or offers an unusually small deposit, it raises questions about their intent. Without the security of an earnest deposit, a seller risks wasted time if the buyer changes their mind. Most legitimate cash buyers are familiar with standard deposit practices and have no issue providing one quickly upon offer acceptance.

Common deposit amounts range from 1–3% of the purchase price, but local customs may influence this. Always ensure that earnest money is held in a trustworthy third-party escrow account rather than with the buyer directly.

Upfront Fees or Payment Requests

Requests for upfront payments or fees from the seller are a classic sign of fraud. Reputable cash buyers do not require the seller to pay administrative fees, processing costs, or anything of the sort in advance. Any cash buyer who asks a seller to send money upfront before closing—whether for inspections, appraisals, or non-refundable deposits—should be treated with suspicion. These requests are usually designed to scam sellers out of money and are not part of standard real estate transactions.

Sellers should only transfer funds at closing through a secure, licensed escrow or title company. Consult with a real estate professional or attorney before making any payment if a buyer makes an unusual request at any stage.

Recognizing Questionable Cash Buyer Tactics

Certain buyer behaviors can signal risk for home sellers, especially when dealing with real estate investors or "we buy houses" companies. Sellers should understand patterns that may indicate suspicious intentions or lack of reliability to protect their interests.

High-Pressure to Close Quickly

Some cash buyers, especially those who market themselves as cash investors, may urge sellers to close almost immediately—sometimes within days of the initial offer. The rationale given might be "market conditions" or a supposed influx of other interested parties.

Red flags include:

Demanding decisions within hours of viewing the property.

Discouraging consultation with attorneys or agents.

Pressuring sellers to sign documents before seeing proof of funds.

Legitimate buyers understand the process and expect sellers to perform due diligence. High-pressure tactics often aim to bypass proper review so the buyer can secure a deal before the seller uncovers unfavorable terms or potential scams.

Unusually Long or Short Inspection Periods

Inspection periods serve to protect both parties, but abnormal timelines should catch a seller's attention. Real estate investors sometimes use very short inspection windows (1-2 days) to deter sellers from seeking second opinions or discovering property issues.

Alternatively, some buyers request unusually long inspection periods, leaving the seller's home off the market for weeks. This tactic may indicate a buyer trying to tie up several properties to choose the most profitable, or one hoping to renegotiate price based on minor inspection results.

Conclusion

Staying alert to key warning signs can help sellers avoid cash buyer scams and costly mistakes. Watch out for buyers who pressure for quick decisions, request odd payment arrangements, or refuse to provide references.

Clear communication, due diligence, and transparency are important at every step. By checking credentials and reading contracts carefully, sellers can protect their interests and complete a safer transaction.

BEFORE YOU GO:

Here are a few more posts you might like:

Upgrades that will Breathe New Life into Your Home Exteriors

Creating a Peace of Mind Plan: How to Prepare for Unexpected Caregiving Roles

See my Link Party Directory for a current list of blog parties I attend each week.

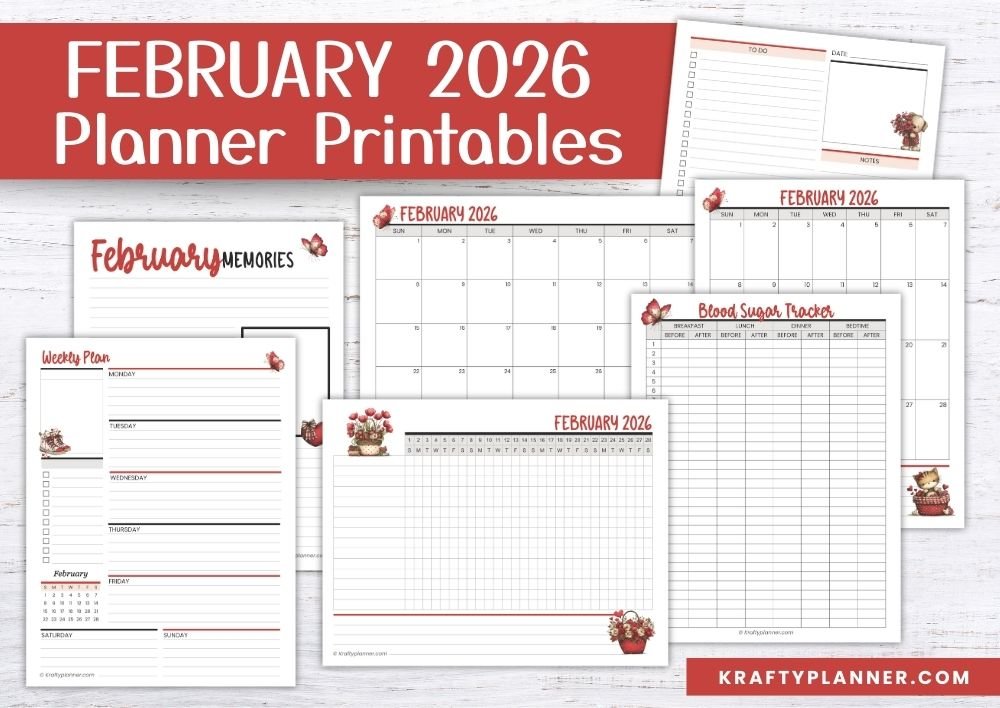

FOR PERSONAL USE ONLY – Please Read Freebies Terms of Use.

(This post may contain affiliate links. For more information, see my disclosures here.)

~ SHARE THIS POST ~

Did you like this post? Do you know someone else who might enjoy it? Please take a minute to share it on Pinterest, Facebook, or your favorite social media… Thank you!