Selling Your Home? Key Factors That Affect Your Timeline and Profit

Selling a home is a project with many moving parts. A simple plan can keep you on track, limit stress, and protect your bottom line. Take a closer look at some considerations to keep in mind during a home sale.

Know Your Local Demand and Buyer Mix

Gauge how buyers are paying in your area. All-cash activity shapes timelines, contingencies, and negotiation style, so it helps to know the share of cash buyers near you. More than 1 in 4 buyers used cash, signaling strong demand from investors and downsizers.

Cash offers can simplify your sale because there is no lender underwriting. You may still see inspection requests or proof-of-funds checks, but the process is much cleaner than financed deals. If you live in Florida and speed matters, explore fast cash offers in Callahan and sell to buyers with no need to pay extra for repairs or real estate agents. Balance the discount some cash buyers seek against your holding costs and risk of fall-through.

Florida sees even more cash activity than the national average. Cash purchases were prevalent across the state in 2024: that pattern can shorten closing times and reduce appraisal risk, but it may influence pricing expectations.

A cash offer can be worth more than the sticker price if it removes appraisal risk or weeks of uncertainty.

Understand Your Timeline Realities

Timelines vary by market, season, and condition of the property. If you want a quick move, focus on strategies that compress days to close, like targeting cash buyers or listing slightly under key price thresholds.

Be clear about your earliest move-out date so you do not accept a contract you cannot meet.

If you have more time, you can widen your buyer pool with minor updates and flexible terms. Ask your agent or attorney to map the sequence from listing to possession, and that includes showings, offer review, inspections, title work, and the handoff of keys.

Price and Net Sheet Planning

Set a pricing range that aligns with recent sales and current competition. Draft a simple net sheet so you understand what you will actually take home at different offer prices. Florida sellers pay about 3.28% of the sale price in typical closing costs, so build that into your math.

Revisit the net sheet as offers arrive. If a buyer asks for credits or repairs, update the figures and compare scenarios side by side.

A clear view of fees, taxes, and payoffs helps you judge whether a slightly lower cash offer beats a higher financed one after costs.

Estimate closing costs

Add mortgage payoff and liens

Include repairs, credits, and concessions

Compare cash vs financed scenarios

Confirm prorations and HOA fees

Inspections, Contingencies, and Risk

Even with cash, many buyers still want an inspection. Industry surveys have found inspection contingencies to be among the most common terms in purchase contracts, which means you should plan for at least a basic review.

Pre-list maintenance can head off surprises and give buyers confidence.

Decide in advance where you will draw the line on repairs or credits. If you prefer fewer back-and-forth negotiations, allow an inspection for information only, or set a cap on repair requests. Clear terms reduce friction and keep your timeline intact.

Paperwork, Disclosures, and Closing Prep

Organize documents early: permits, HOA rules, utilities, survey, and receipts for major work. Clean paperwork speeds title review and makes it easier for buyers to say yes. Keep digital copies handy to share quickly after you accept an offer.

Ask your title or closing agent for a draft settlement statement. Review prorated taxes, HOA balances, and any municipal liens. A careful look now avoids last-minute corrections on closing day.

Homestead and Move Planning

If you are selling a primary residence and buying another in Nassau County, mark your calendar for the homestead filing. The county office reminds residents that property used as a permanent residence in 2025 can be filed for the 2026 Homestead Exemption through March 1, 2026.

If you are changing homesteads, talk with the appraiser about timing and any portability options that may apply to you.

Plan your move with buffer days for cleaning, utility transfers, and final walkthrough items. If you need post-closing occupancy, negotiate it before you sign the contract. Clear terms help both sides schedule movers and avoid storage surprises.

Counting the Real Costs

Closing costs are only part of the equation. Add in prep work, staging, and any pre-inspection fixes. That total should sit next to your expected sale price and your target net number.

Different buyers come with different costs. A financed buyer might need repairs for loan approval, whereas a cash buyer might accept an as-is price adjustment.

Compare the tradeoffs with your net sheet so the best choice is obvious on paper.

Selling a house takes planning, but a simple checklist and clear numbers make decisions easier. Map your timeline, keep documents tidy, and weigh price against risk and speed. That way, your sale supports the next chapter you have in mind.

Before you go:

You might also be interested in…

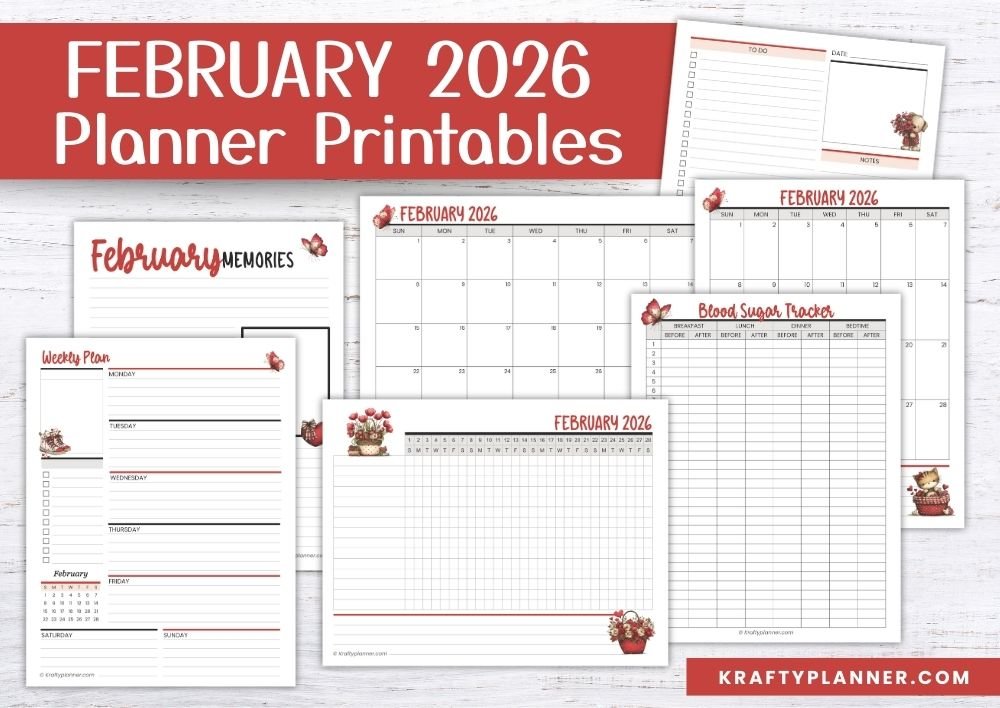

FOR PERSONAL USE ONLY – Please Read Freebies Terms of Use

(This post may contain affiliate links. For more information, see my disclosures here.)

~ SHARE THIS POST ~

Did you like this post? Do you know someone else who might enjoy it? Please take a minute to share it on Pinterest, Facebook, or your favorite social media… Thank you!